You shouldn't be left with money worries

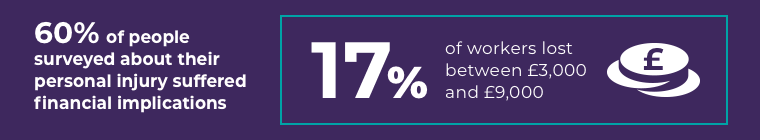

It's hard to be financially ready for an accident you weren't expecting. Not many people have the money saved up to pay for the specialist treatment they need to help them get back on their feet.

Recovering from an injury is stressful enough without the added worry of your finances. But when you're the victim of an accident that wasn't your fault, you can be left feeling unprepared and anxious about the situation you're now in. That's where compensation can help.

Making a no win no fee compensation claim can ease your money worries by helping you recover your lost earnings from time off work. We consider the full impact of your injury when you make your claim, so your compensation can also cover the extra costs you've had as a result of your injury.

Find out how much compensation you could receive

We know a big factor in deciding whether to claim is understanding how much compensation you might receive.

While we can't advise you when you call us how much your claim might be worth, we have created a market-leading compensation calculator that uses industry figures and details of your experience to give you an idea of how much compensation you might be able to claim.

Your compensation can help with...

Your compensation figure is calculated on all the costs and losses you've experienced as a result of your accident. This includes, but is not solely based on:

- Your loss of earnings from lack of pay or sick pay

- The loss of earnings suffered by your family members

- Any care you've been given, even when that care was given for free

- Any expenses you've had to cover such as adapted travel costs (bus or train tickets or taxis) and prescriptions

Although the financial impact of your injury and the future impact of your accident is taken into account when calculating your compensation, the money you receive can be spent in any way you feel best.

That means you can use your compensation to pay for specialist treatment, to cover your mortgage and rental costs, or use it as savings that you can dip into when you need.

Interim payments

In serious cases, you or your loved one may be left completely unable to work. You may have had to stay in hospital or could need long-term treatment. You may also require immediate adaptations to your home or vehicle.

Your solicitor might be able to arrange for you to receive an interim compensation payment sooner than you receive the rest of your money, in order to cover the immediate impact of your injury.

This could help to cover your mortgage or rental payments before you receive your final compensation figure, or could cover the costs of putting your loved ones up in a hotel near to where you are being treated.

Your solicitor can talk through the process of claiming an interim payment and will also do the negotiating on your behalf so that you don't need to stress about any extra workload during this distressing time.

Four tips to help with debt

Below are four tips to help you manage your debt and money worries, whether you're making a claim with us or not. However, if you're feeling anxious we also recommend speaking to the Citizen's Advice Bureau who offer free advice about debt management on their website.

Decide which are your priority debts

Our first recommendation for managing your debts is to make sure you list which ones are your most important and biggest priority. Typically, these are the debts that have the biggest consequences if you don't pay them.

For example, if you miss multiple mortgage payments you run the risk of losing your home.

Once you've decided which debts have the biggest consequences, work on covering the cost of these first.

If you are making a claim with us and are struggling to cover your living costs, you may able to ask for an immediate needs assessment and receive an interim compensation payment. Your solicitor can talk you through this as part of your claim with us.

Check if you can get financial help

If you're struggling financially it's worth speaking to HM Revenue and Customs to see if you're entitled to any benefits from the Government.

You might be able to receive tax credits or supporting benefits, depending on your income and circumstances.

Create a budget

To make sure you're living within your means and to highlight where you may be able to pull back some costs, we recommend creating a list of everything you spend.

For example, you might find that you are regularly spending small sums at your local shop when you could purchase the same items for less as part of a weekly shop.

Don't bury your head in the sand

We know that it can be tempting to ignore letters or calls from the people you owe money to, also known as creditors. But no matter how tempting this is, don't do it. Ignoring problems can often make them worse in the long term.

By speaking to the people who you owe money to, you can work with them to create a better situation for yourself. Many reputable organisations will be willing to help you if you ask them and explain your situation.

Equally, if you're struggling to make payments on your debts because you've been injured and are earning less than you usually would, you can speak to your creditors and contact us about making a compensation claim.

When you claim with us the full impact of your injury is considered, and that includes the physical, emotional and financial impact. So if you're suffering from more debt as a result of your injury, we'll consider this and help you claim compensation to cover these costs.