What we know about personal injury

At National Accident Helpline we know from our daily conversations with injured people just how much a personal injury can affect every aspect of a person's life, from the financial cost of loss of earnings and medical bills, to the emotional stress on an individual and their family. The aftermath of an accident can be a hugely overwhelming time.

As the UK's leading provider of personal injury advice, services and support, we wanted to uncover the financial, emotional and practical effect that a personal injury can have - from loss of earnings to stress and lifestyle changes, as well as the ripple effect on friends and family.

The Real Cost of Personal Injury report

Working alongside independent research organisation YouGov, we've undertaken a wide-ranging survey to provide a snapshot of the challenges faced for those injured through no fault of their own. We've written up these findings in a report, The Real Cost of Personal Injury.

The report includes a full breakdown of the research as well as a number of case studies that illustrate how a personal injury can leave people feeling at their lowest point.

The Real Cost of Personal Injury report.

Click To download the full reportWhat we have found out

The following are just some of the issues we uncovered, ranging from significant financial losses to life-changing career consequences, along with very real fears and concerns:

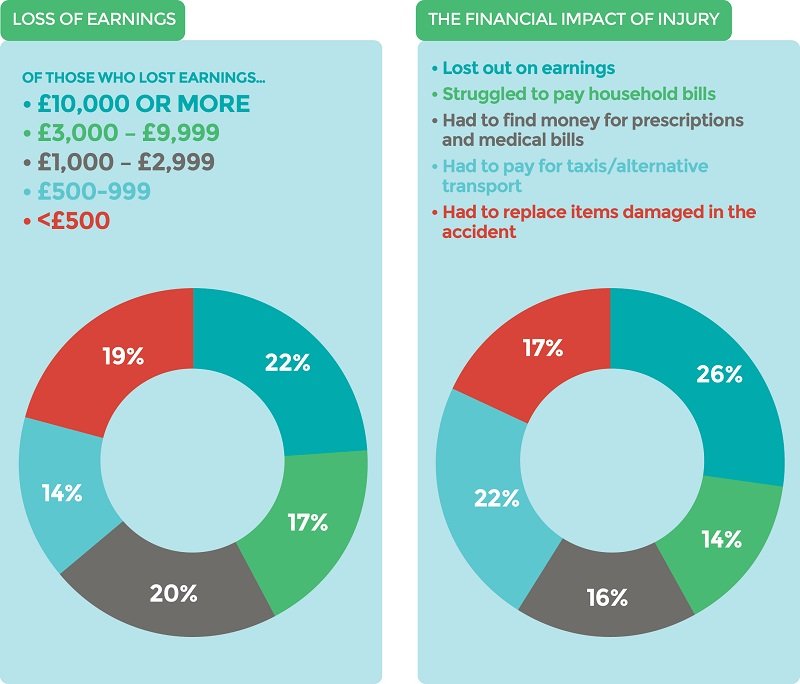

- More than a quarter (26%) of Brits surveyed who suffered a personal injury which was not their fault lost out on earnings

- Of those who lost earnings, over one in five (22%) lost £10,000 or more

- Over a third (35%) had to take more than a month off work or other essential commitments

- In fact, just over one in 10 (11%) lost or had to give up their job completely

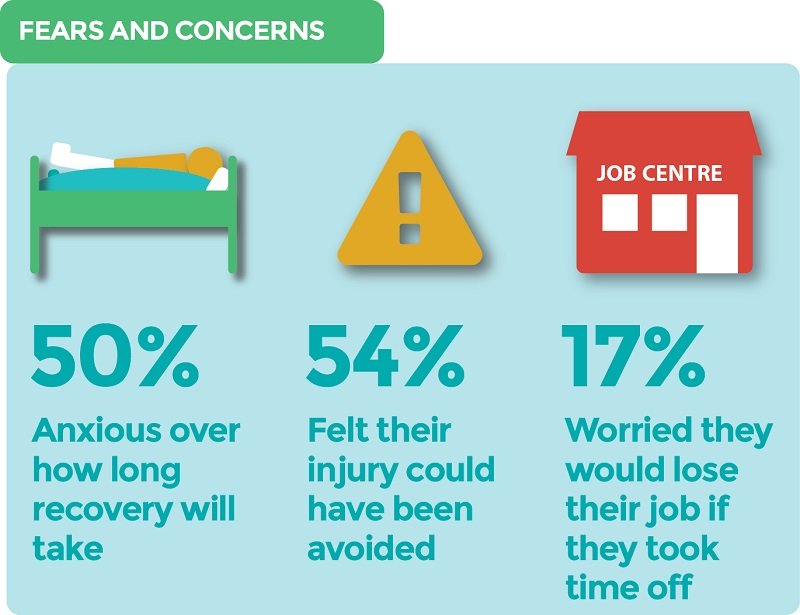

- Half (50%) were anxious about how long they would take to recover

- 17% were concerned they would lose their job if they took time off work

- Almost one in five (19%) felt guilty about the impact on their spouse or partner

What do people think?

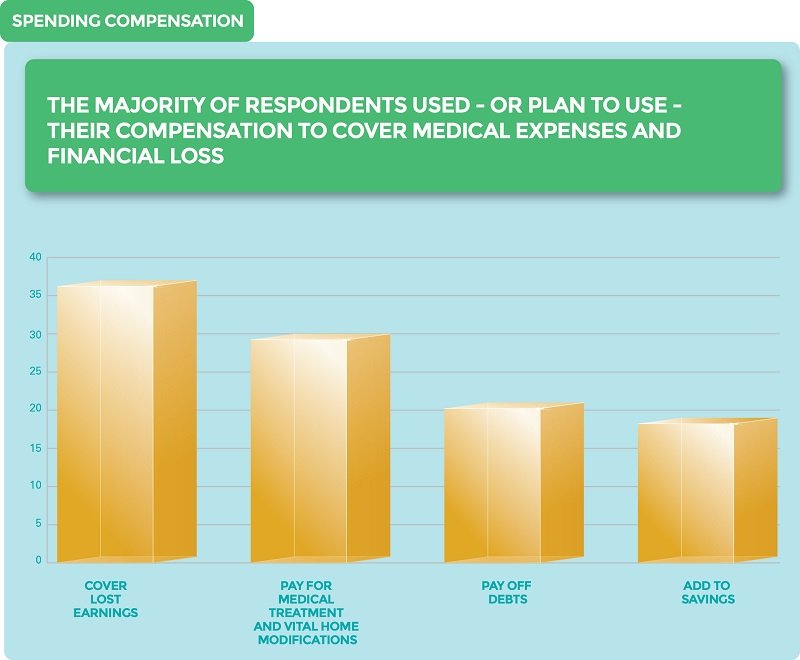

Meanwhile, challenging the perception of a compensation culture in the UK, we found that the overwhelming majority of respondents who have or intend to make a claim used or intended to use their compensation to get back to the position they were in before suffering their accident or injury - exactly what compensation is intended to do.

- 37% used or plan to use their compensation to replace lost earnings

- 30% said it was to cover the cost of rehab and medication

- 21% of respondents said they used their claim to pay off debts

- 19% added to their savings

Claiming is not just about securing financial recompense, however. Almost a third (32%) of those who made a claim said they wanted to make sure the same accident couldn't happen to someone else.

Respondents to our survey also cited feelings of anger and frustration at those who had caused their accident, and in many cases a desire for an apology.

- 47% were angry and/or frustrated with the person or company who caused their accident

- 37% were keen for the person or company at fault to acknowledge responsibility and apologise

- 54% felt their injury could have been avoided

Yet despite the worthwhile uses cited for compensation and, for many, the desire to create a safer environment and right a wrong by making a claim, more than one in five (21%) of those who made a claim feel there is a ‘compensation culture' in the UK - and the figure rises to more than two in five (42%) among non-claimants.

The background

It's critical to understand the real cost of personal injury to an individual, as we know the legal landscape is set to change - partly in response to the widespread view that the UK is in the grip of so-called compensation culture.

The Government is currently considering plans to raise the small claims limit for personal injury to £5,000 and remove the right to general damages for soft tissue injuries.

The proposed changes are mainly aimed at tackling fraudulent claims and reducing the number of nuisance calls made by rogue companies in the personal injury sector.

However, they would increase the number of cases going through the small claims court, where legal costs can't be recovered from the losing side, and we could see more people with life-altering injuries and complex claims having to represent themselves in court.

These changes would significantly reduce access to justice and legal advice that many people need.

So while we're pleased that a number of sensible proposals, including action against nuisance calls, have been made, we are also focused on ensuring that the rights of genuine claimants are effectively balanced with the goal of tackling fraud.

What we will do

Using our research, we will continue to work with the Government to ensure that people with legitimate cases are supported to get their lives back on track, and secure the justice they deserve.

We want the voices of personal injury sufferers to be heard amongst this noisy debate.